How Much "Upside" Is There for Private Equity in AI?

Bottom Line: $700B - $2.1T in PE upside is available

Productivity is the best measure to look at real value driven.

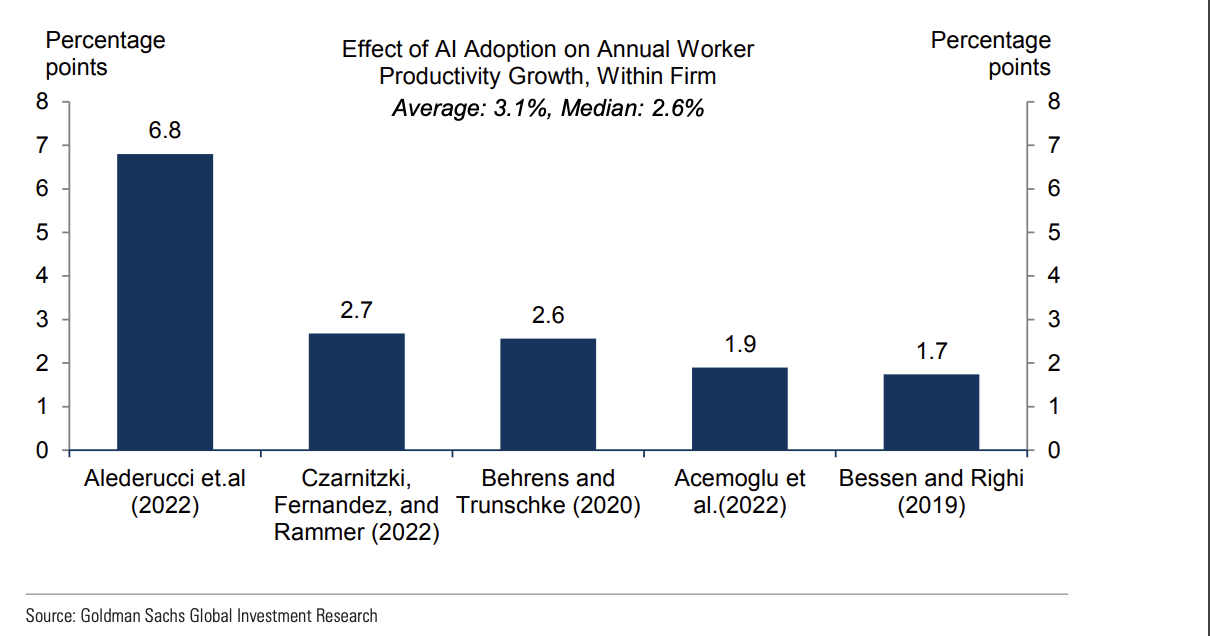

What the Data Says: Productivity Growth

Goldman Sachs estimates productivity increase of 2.6pp per year median.

Private Equity realization will be considerably higher (in my opinion). PEAI firms will select portfolio companies that have AI productivity upside. PEAI portfolios as a result will have positive selection bias.

What does the Data Say: GDP Growth?

Goldman Sachs1 estimates GDP growth of $7T attributed to AI. Assuming a conservative multiplier2 of 2-3x GDP to Enterprise Value, we could estimate an additional $14-21 trillion in enterprise value creation across the economy3.

Applying our estimated global labor productivity boost to countries in our coverage implies that widespread AI adoption could eventually drive a 7% or almost $7tn increase in annual global GDP over a 10-year period

What are the implications for the size of PE Value Creation?

If we assume that private equity firms capture even 5-10% of the estimated $14-21 trillion in enterprise value creation, this would mean an additional $700 billion to $2.1 trillion in enterprise value specifically within PE portfolios.

PE runs ~$900B in fundraising per year. This is the equivalent of 70% - ~200% of annual fundraising.

Goldman Sachs: Global Economics Analyst The Potentially Large Effects of Artificial Intelligence on Economic Growth (Briggs/Kodnani)

I am solving for “order of magnitude” correct and not going for precision. Currently we know that US GDP is ~$29T and that US Equites are worth $55T. We also know that revenue of US publicly traded companies is ~2/3 of the US economy.

This assumes Market Cap/EBITDA stays roughly the same. There is a case to be made there will be strong deflation.